From $54B to $85B: A Promising Decade for North America IVD

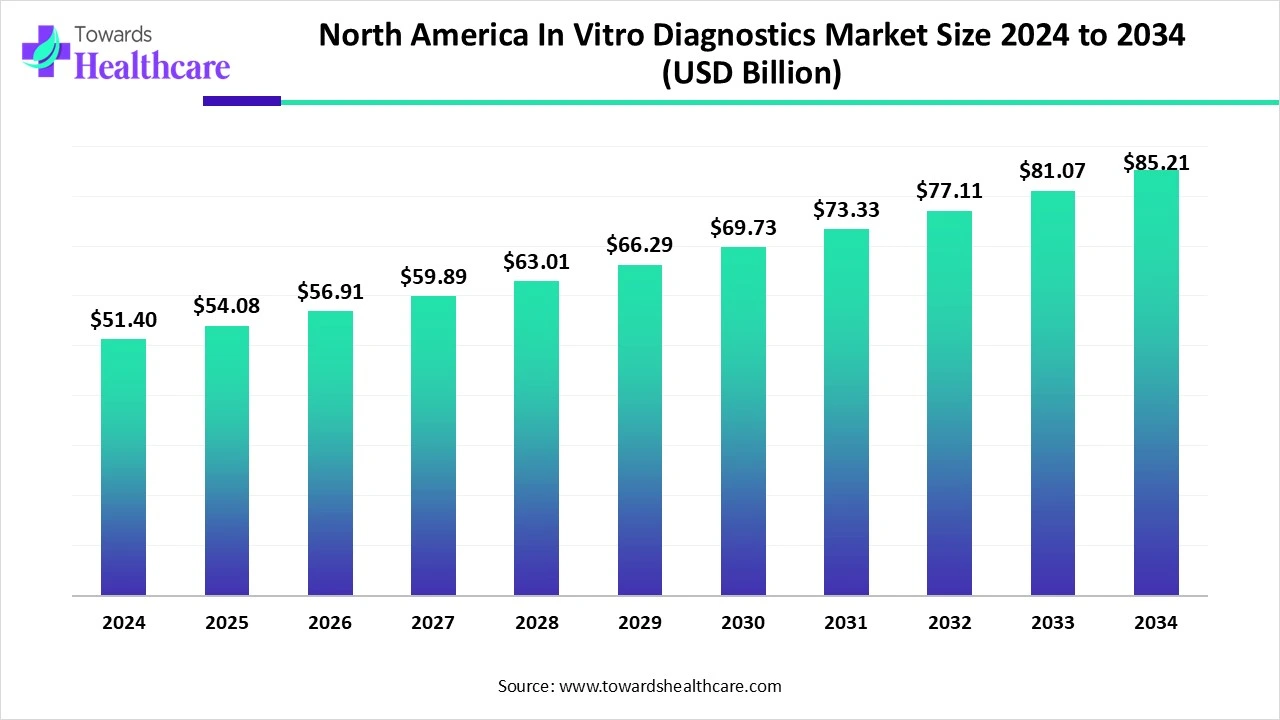

The North America in-vitro diagnostics market size was valued at USD 54.08 billion in 2025 and is predicted to hit around USD 85.21 billion by 2034, rising at a 5.23% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 12, 2026 (GLOBE NEWSWIRE) -- The North America in-vitro diagnostics market size is calculated at USD 56.91 billion in 2026 and is expected to reach around USD 85.21 billion by 2034, growing at a CAGR of 5.23% for the forecasted period.

Get a Closer Look at North America’s Diagnostics Journey | Download a Free Sample Now @ https://www.towardshealthcare.com/download-sample/5626

Key Takeaways

- The North America in vitro diagnostics sector pushed the market to USD 51.4 billion by 2024.

- Long-term projections show a USD 85.21 billion valuation by 2034.

- Growth is expected at a steady CAGR of 5.23% in between 2025 and 2034.

- The North America in-vitro diagnostics sector is pushing the market to USD 51.4 billion in 2024.

- Long-term projections show a USD 85.21 billion valuation by 2034.

- Growth is expected at a steady CAGR of 5.23% in 2025.

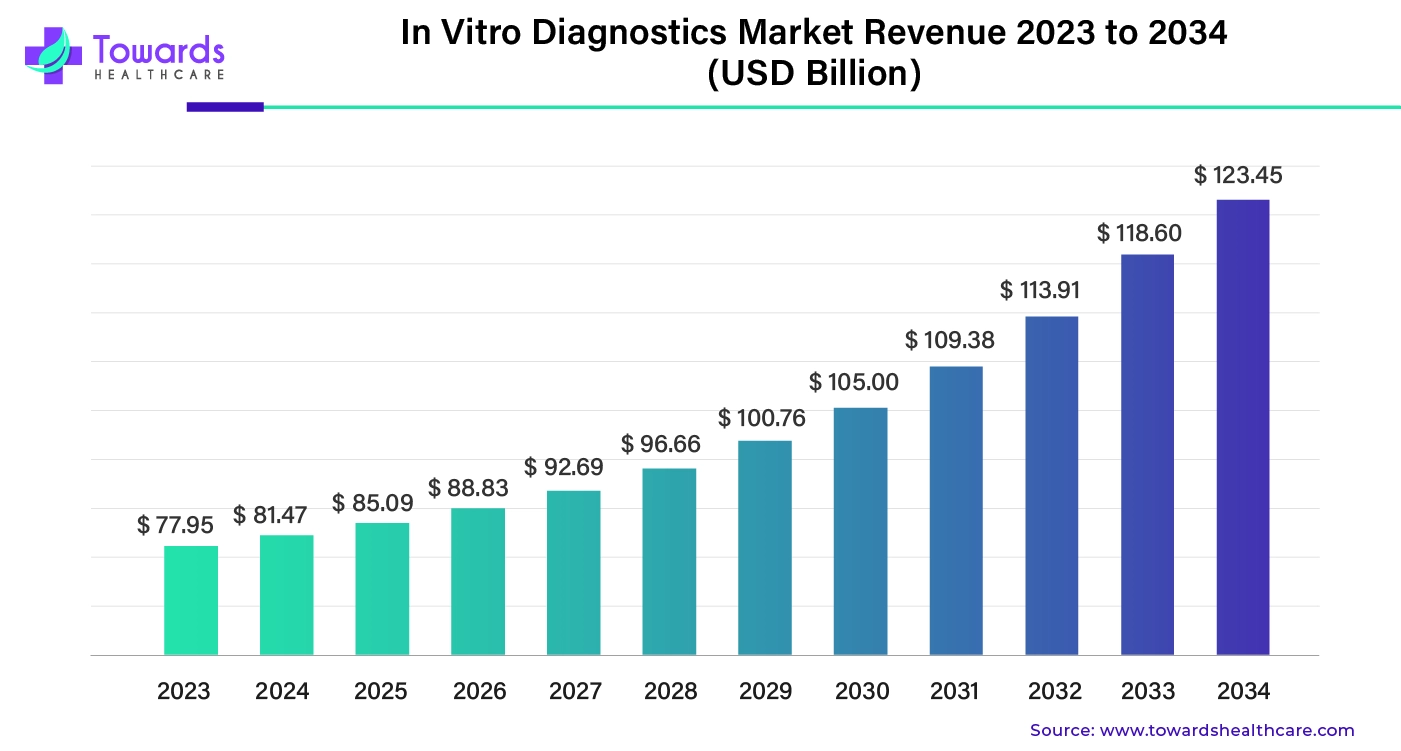

- By 2025, the global in vitro diagnostics market is projected to reach around $85.09 billion, growing at a CAGR of 4.45%.

- By product, the reagents segment was dominant in the North America in vitro diagnostics market in 2024.

- By product, the services segment is expected to grow at a rapid CGAR in the coming years.

- By technology, the immunoassay segment registered dominance in the market in 2024.

- By technology, the microbiology segment is expected to witness the fastest growth during 2025-2034.

- By application, the infectious diseases segment dominated the market in 2024.

- By application, the oncology segment is expected to grow rapidly in the studied years.

- By end-use, the hospitals segment led the North America in vitro diagnostics market in 2024.

- By end-use, the homecare segment is expected to be the fastest-growing during the forecast period.

Stay ahead in life sciences with exclusive insights from our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

How are the North American In Vitro Diagnostics Emerging?

The North America in vitro diagnostics market is primarily fueled by the ongoing AI integration, molecular diagnostics, and a robust shift towards point-of-care (POC) & home testing. Alongside, the region is pushing FDA approvals for new blood-based tests, like those for Alzheimer's and cancer, and also fostering breakthroughs in automation for expedited, decentralized outcomes.

What are the Key Drivers in the North America In Vitro Diagnostics Market?

A significant catalyst is the emergence of key investments in healthcare, with the possession of suitable reimbursement policies for diagnostics. Several firms are promoting innovations in molecular diagnostics, point-of-care testing (POCT), and AI-assisted diagnostics, enabling rapid, more precise, and convenient, often remote, testing.

Drifts in the North America In Vitro Diagnostics Market

- In January 2026, Biocartis collaborated with Mayo Clinic in the US to establish an accelerated sample-to-answer test, which leads to faster and more efficacious treatment for breast cancer patients.

- In December 2025, Cofactor Genomic received investments from Labcorp & Ascension Ventures to speed up Cofactor’s nationwide progression and expand patient access to its immunotherapy-response diagnostics.

- In November 2025, Freenome agreed with Roche & focused on commercialising its cancer screening technology outside the US.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What is the Key Challenge in the North America In Vitro Diagnostics Market?

Firstly, the need for higher expenditures for molecular analyzers and automated platforms is an emerging obstacle, mainly for smaller laboratories, with additional spending on maintenance and consumables. Moreover, in some cases, players may face the FDA’s robust, time-consuming approval processes and compliance requirements for novel tests, which limit faster commercialization.

Country Analysis

U.S. Market Trends

The U.S. was a huge contributor to the respective market, as emphasized by at-home and point-of-care (POC) solutions. A recent FDA approval includes Visby Medical Women’s Sexual Health Test as the first rapid at-home PCR assay for chlamydia, gonorrhea, and trichomoniasis. Alongside, bioMérieux’s system secured FDA authorisation for a rapid, 15-minute multiplex PCR test for respiratory pathogens.

Canada Market Trends

In the last few months, Canada’s Drug Agency published new pan-Canadian recommendations, raising the recommended screening from 25 conditions to 54, and finally fueling demand for rare-disease testing platforms. As well as, QuidelOrtho Corporation acquired Health Canada approval for its Triage PLGF test for laboratory use, a fluorescence immunoassay used for managing pregnancy-related risks.

Global In Vitro Diagnostics Market Size and Growth Factors

The global in vitro diagnostics market was estimated at US$ 77.95 billion in 2023 and is projected to grow to US$ 123.45 billion by 2034, rising at a compound annual growth rate (CAGR) of 4.45% from 2024 to 2034.

The In Vitro Diagnostics (IVD) market is growing steadily as healthcare systems become more advanced and accessible. Hospitals and labs are using more modern diagnostic tools, which is increasing the demand for IVD products.

One major growth factor is the expansion of the medical device industry. As new healthcare equipment enters the market, the need for accurate diagnostic testing also rises.

Turn IVD market data into your next growth move | Checkout and get premium market insights now @ https://www.towardshealthcare.com/checkout/5229

Segmental Insights

By product analysis

Which Product Led the North America In Vitro Diagnostics Market in 2024?

The reagents segment held a major share of the market in 2024. This is propelled by the incorporation of specialized chemical, biological, or immunological substances in laboratory tests on human samples to find, diagnose, and monitor diseases. The region is promoting automated analyzers, which need boosted, ready-to-use reagent kits to raise efficiency & accuracy.

On the other hand, the services segment will expand rapidly. This mainly covers diverse molecular diagnostics, immunoassays, and automated lab solutions, as well as advanced AI-integrated solutions. A substantial instance is that Illumina fully combined its XLEAP-SBS chemistry into all reagents for NextSeq 1000/2000 instruments, which crucially raises the speed and accuracy of genetic testing.

By technology analysis

How did the Immunoassay Segment Dominate the Market in 2024?

In 2024, the immunoassay segment captured the biggest share of the North America in vitro diagnostics market. Across the region, a rise in diabetes, cancer, cardiovascular diseases, and infections, like HIV and hepatitis, is highly impacting this technology. Also, they are looking for quicker, easy-to-use POC immunoassay devices, especially in clinics. Recently, the FDA cleared the Sofia 2 SARS Antigen FIA assay for rapid, high-sensitivity COVID-19 testing.

Moreover, the microbiology segment is predicted to expand fastest. The market is widely adopting Polymerase Chain Reaction (PCR), next-generation sequencing, & automated platforms, which allow faster, precise pathogen identification. Recently, the FDA approved a few extensive solutions, like Inflammatix TriVerity Test for a host-response test to evaluate sepsis and infection severity, and also MeMed Sepsis Test for bacterial/viral differentiation.

By application analysis

Which Application Dominated the North America In Vitro Diagnostics Market in 2024?

The infectious diseases segment registered dominance in the market in 2024. North America is experiencing a greater need for testing in HIV, Hepatitis B & C, tuberculosis, respiratory pathogens, and COVID-19. Continuous advances includes expansion of Haystack Analytics’s infexn NGS test to determine respiratory RNA viruses, with efficient detection of antimicrobial resistance.

Whereas the oncology segment is anticipated to register rapid growth. Surging geriatric population in the U.S. and Canada is fueling the wider adoption of Next-Generation Sequencing (NGS), PCR, and liquid biopsies in the rising cancer cases. Additionally, Canadian researchers are increasingly transforming cancer-specific antigen tests, with trials for vaccines targeting lung and breast cancer, which is predicted to start within two years.

By end-use analysis

Why did the Hospitals Segment Lead the Market in 2024?

In 2024, the hospitals segment captured a dominant share of the North America in vitro diagnostics market. It is empowered by a booming pool of ageing patients, a greater adoption of automated laboratory systems to enhance effectiveness, lower turnaround times, and handle high patient throughput. Recently, Quest Diagnostics revealed plans for a CAD 1.35 billion acquisition of Canada-based LifeLabs to bolster testing capacity and speed up innovation.

However, the homecare segment will expand rapidly. Widespread patients and providers are prioritizing POCT devices to enable rapid, actionable results & skipping hospital visits, which fosters convenience and optimizes patient outcomes. Furthermore, prominent telehealth companies, like Wisp, are strengthening their diagnostics vertical to encompass at-home test kits followed by follow-up care, which integrates diagnostics with treatment.

Let’s collaborate and create insights that move industries forward - https://www.towardshealthcare.com/schedule-meeting

What are the Key Developments in the North America In Vitro Diagnostics Market?

- In January 2026, Insight Molecular Diagnostics Inc. unveiled its GraftAssureDx test kit clinical trial and strategic in vitro diagnostic (IVD) de novo submission to the US FDA.

- In December 2025, Roche launched the new cobas 6800/8800 systems version 2.0 and software version 2.0.1 to assist in a more simplified diagnostics experience for healthcare professionals and their patients.

-

In October 2025, Augurex Life Sciences Corp. & MitogenDx explored the JOINTstat blood test and broadened access to advanced rheumatoid arthritis (RA) diagnostic testing and disease monitoring for clinicians and patients across Canada.

Key Players

- Abbott

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- BD

- Siemens Healthcare GmbH

- QIAGEN

- Quidel Corporation

- F. Hoffmann-La Roche Ltd

- Sysmex Corporation

- Charles River Laboratories International, Inc.

- Quest Diagnostics

- Agilent Technologies, Inc.

- Danaher

Browse More Insights of Towards Healthcare:

The Europe in-vitro diagnostics market size is calculated at USD 27.5 in 2024, grew to USD 29.13 billion in 2025, and is projected to reach around USD 48.92 billion by 2034. The market is expanding at a CAGR of 5.93% between 2025 and 2034.

The Asia Pacific in vitro diagnostic market size is calculated at USD 21.8 billion in 2024, grows to USD 23.25 billion in 2025, and is projected to reach around USD 41.46 billion by 2034. The market is expanding at a CAGR of 6.64% between 2025 and 2034.

The global in vitro release testing (IVRT) market size is calculated at USD 65.66 million in 2024, grow to USD 75.17 million in 2025, and is projected to reach around USD 252.64 million by 2034. The market is expanding at a CAGR of 14.47% between 2025 and 2034.

The global in vitro lung model market size was estimated at US$ 312 million in 2023 and is projected to grow to US$ 1,653.59 million by 2034, rising at a compound annual growth rate (CAGR) of 17.7% from 2024 to 2034.

The Latin America life science market size began at US$ 4.49 billion in 2024 and is forecast to rise to US$ 4.90 billion by 2025. By the end of 2034, it is expected to surpass US$ 12.05 billion, growing steadily at a CAGR of 10.38%.

The global viral vector manufacturing market size is calculated at USD 1.82 billion in 2025, grows to USD 2.21 billion in 2026, and is projected to reach around USD 12.91 billion by 2035. The market is expanding at a CAGR of 21.64% between 2025 and 2034.

The global clinical diagnostics market size was estimated at USD 123.22 billion in 2025 and is predicted to increase from USD 131.4 billion in 2026 to approximately USD 234.36 billion by 2035, expanding at a CAGR of 6.64% from 2026 to 2035.

The global cancer diagnostics market size is calculated at USD 109.65 billion in 2024, grow to USD 116.42 billion in 2025, and is projected to reach around USD 199.54 billion by 2034, rising at a 6.17% CAGR for the forecasted period of 2025 to 2034.

The DNA diagnostics market size was estimated at US$ 10.69 billion in 2023 and is projected to grow to US$ 17.44 billion by 2034, rising at a compound annual growth rate (CAGR) of 4.55% from 2024 to 2034. The rising prevalence of genetic disorders, growing genomics research, and increasing investments drive the market.

The global immunodiagnostics market was predicted at US$ 19.1 billion in 2023 and is projected to grow to US$ 70.9 billion by 2034, rising at a compound annual growth rate (CAGR) of 12.84% from 2024 to 2034. The widespread applications of immunodiagnostics techniques, including ELISA, radioimmunoassay, and lateral flow assays in the detection of infectious and autoimmune diseases, allergic conditions, and cancer, are contributing to the expansion of the immunodiagnostics market.

Segments Covered in the Report

-

By Product

- Instruments

- Reagents

- Services

-

By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

- Immunoassay

-

By Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Others

-

By End-use

- Hospitals

- Homecare

- Laboratory

- Others

-

By Region

- North America

- U.S.

- Canada

- North America

Get the Full Insights and Data Behind North America’s IVD Growth | Instant Delivery Available @ https://www.towardshealthcare.com/checkout/5626

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Also Read:

https://www.towardshealthcare.com/insights/ngs-kits-market-sizing

https://www.towardshealthcare.com/insights/us-tuberculosis-tb-diagnostics-market-sizing

https://www.towardshealthcare.com/insights/ai-in-cancer-diagnosis-transforming-cancer-care

https://www.towardshealthcare.com/insights/us-oncology-molecular-diagnostics-market-sizing

https://www.towardshealthcare.com/insights/core-clinical-molecular-diagnostics-market-sizing

https://www.towardshealthcare.com/insights/allergy-diagnostics-market-sizing

https://www.towardshealthcare.com/insights/oncology-molecular-diagnostics-market-sizing

https://www.towardshealthcare.com/insights/thyroid-cancer-diagnostics-market-sizing

https://www.towardshealthcare.com/insights/allergy-diagnostics-and-therapeutics-market

https://www.towardshealthcare.com/insights/malaria-diagnostics-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.