Global 3D Printing Filament Market Projected to Nearly Triple by 2034

Market to expand from USD 2.88B in 2026 to USD 7.55B by 2034 at a 12.81% CAGR

Innovations in high-performance filaments and the growing shift toward functional part production are key drivers shaping the global 3D printing filament market’s robust expansion.”

PUNE, MAHARASHTRA, INDIA, February 10, 2026 /EINPresswire.com/ -- The global 3D printing filament market is poised for robust expansion through the forecast period, according to a recent research report by Fortune Business Insights™. The market was valued at USD 2,513.11 million in 2025 and is expected to grow from USD 2,879.27 million in 2026 to USD 7,552.80 million by 2034, exhibiting a compound annual growth rate (CAGR) of 12.81% during the forecast period.— Fortune Business Insights

Get a Free Sample PDF - https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/3d-printing-filament-market-115196

3D printing filament is the primary consumable material used in fused deposition modeling (FDM) or fused filament fabrication (FFF) 3D printers. These filaments are deployed across prototyping, tooling, functional parts production, and end-use components in industries ranging from aerospace to healthcare. The market’s expansion reflects rapid adoption of 3D printing technologies, increased industrial applications, and a shift from basic to advanced materials that meet diverse performance requirements.

A growing installed base of 3D printers worldwide is a key driver of filament demand. Millions of FDM/FFF printers in operation continue to generate recurring purchases of filament materials as both hobbyists and industrial users increase usage. As 3D printing transitions beyond rapid prototyping to production of tooling, jigs, fixtures, and final parts, filament consumption is rising significantly. Industrial users typically consume several times more filament per printer than individual users, further accelerating market growth.

Market Drivers and Growth Factors

One of the primary drivers of growth is the ongoing shift from basic filaments like PLA and ABS toward engineering and composite materials such as PETG, nylon (PA), TPU/TPE, and carbon-fiber reinforced filaments. These advanced materials offer enhanced mechanical performance, durability, and heat resistance, making them suitable for demanding applications across automotive, aerospace, and industrial manufacturing.

Increasing adoption of 3D printing for functional parts and end-use components also propels the filament market. Manufacturers and designers are increasingly relying on additive manufacturing to produce customized parts with reduced lead times and material waste. Growing demand for lightweight, high-strength components particularly in sectors such as aerospace and defense intensifies filament usage and supports higher average selling prices for specialty materials.

Healthcare represents another important growth opportunity for filament demand. Hospitals and medical device manufacturers are using 3D printing to produce patient-specific anatomical models, surgical guides, prosthetics, orthotics, and other medical tools. Filaments such as PLA and PETG are commonly used for anatomical models, while TPU and other flexible materials are increasingly utilized in prosthetics and wearable components.

Get a Free Sample PDF - https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/3d-printing-filament-market-115196

Market Restraints and Challenges

Despite strong growth prospects, several factors pose challenges to market expansion. The high cost of advanced and specialty filaments — which can be significantly more expensive than basic materials — can limit adoption among small businesses, educational institutions, and hobbyists with constrained budgets. Quality inconsistencies among filament manufacturers, leading to issues such as diameter variations and moisture sensitivity, can also result in print failures and material waste, increasing operating costs.

Additionally, volatility in raw material prices and supply chain disruptions can impact production stability and pricing. Filament production depends on petroleum-based polymers and additives, whose costs fluctuate with changes in crude oil prices, energy markets, and global supply conditions. Disruptions in supply chains can delay procurement of raw materials and colorants, affecting product availability and lead times.

Market Trends

A key trend in the 3D printing filament market is the growing demand for sustainable and bio-based filaments. Manufacturers are increasingly introducing recycled or biodegradable filaments to address environmental concerns and meet sustainability objectives. This trend aligns with broader industry efforts to reduce the environmental footprint of additive manufacturing processes.

Print farms and service bureaus are expanding rapidly, providing bulk 3D printing services for industrial and commercial clients. These operations create consistent, high-volume filament consumption, supporting demand for professional-grade materials. As enterprises adopt 3D printing for on-demand production and localized manufacturing, filament usage is expected to remain strong across multiple sectors.

Market Segmentation

The report segments the global 3D printing filament market by material type, application, end-use industry, and region.

By Material Type

Material types include PLA (Polylactic Acid), ABS (Acrylonitrile Butadiene Styrene), PETG (Polyethylene Terephthalate Glycol), nylon (polyamide), TPU/TPE, composite filaments, polycarbonate (PC), and others. In 2025, the PLA segment dominated the market due to its ease of printing, dimensional stability, cost effectiveness, and biodegradable nature, which supports sustainability goals.

The composite filaments segment is expected to grow at the fastest rate, driven by demand for materials that provide higher mechanical strength and enhanced performance characteristics for demanding industrial applications.

Get a Free Sample PDF -https://www.fortunebusinessinsights.com/enquiry/customization/3d-printing-filament-market-115196

By Application

Market applications include prototyping, functional parts and end-use components, tooling and fixtures, visual models and concept design, educational and training models, and others. The prototyping segment held the largest share in 2025 due to the widespread use of 3D printing in design validation, iterative testing, and product development across industries.

The functional parts and end-use components segment is also expected to register robust growth as organizations increasingly deploy 3D printing for production-ready parts and tooling solutions that offer cost savings and design flexibility.

By End-Use Industry

End-use industries include aerospace & defense, automotive, healthcare & medical devices, consumer electronics, industrial manufacturing, and others. In 2025, the aerospace & defense segment dominated the market, reflecting the sector’s early adoption of additive manufacturing for lightweight parts, complex tooling, and customized components.

Regional Outlook

Geographically, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

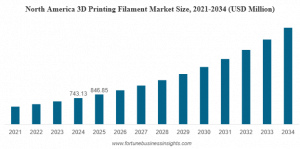

North America held the largest share of the global 3D printing filament market in 2025, with a market value of USD 846.85 million. This leadership position is supported by widespread adoption of additive manufacturing in aerospace, automotive, healthcare, and industrial sectors, a large installed base of 3D printers, strong R&D infrastructure, and important filament manufacturing capabilities.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sambit.k@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.